High-quality, income-generating properties with stable occupancy and long-term lease agreements.

Investments in residential, commercial, industrial, and alternative real estate sectors such as data centres, logistics, and student housing.

Properties with strong upside potential through renovations, repositioning, or redevelopment.

Private lending, mezzanine financing, and structured investment solutions for real estate development projects.

Acquisition of high-quality commercial assets with strong cash flow and appreciation potential.

Secured lending solutions backed by premium commercial properties.

Collective investment vehicles for scalable exposure to premium real estate assets.

Access to high-performing commercial real estate funds managed by industry experts.

Prime retail investments in high-traffic locations.

Premium-grade commercial buildings in key business districts.

High-quality projects with strategic long-term value.

High-growth assets driven by e-commerce expansion.

Profitable opportunities in Australia’s booming tourism sector.

Niche commercial real estate opportunities tailored to unique investor needs.

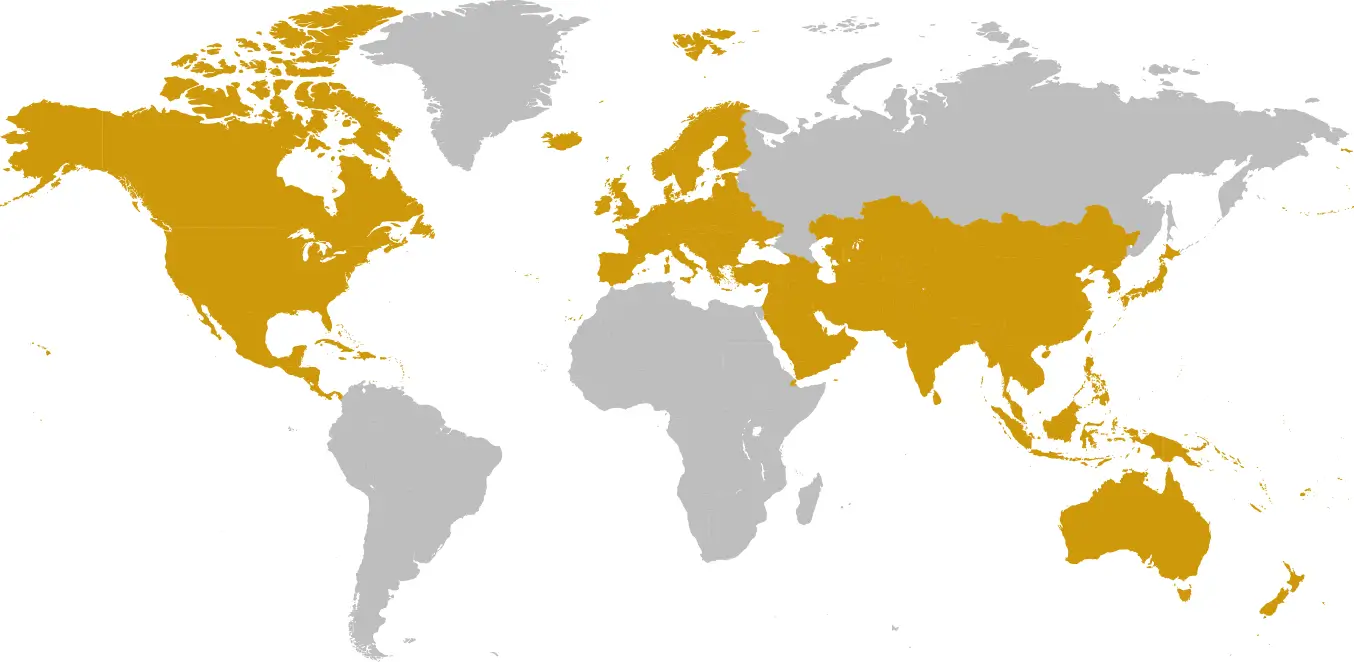

Pension funds, endowments, and sovereign wealth funds looking for stable, large-scale real estate investments that provide long-term capital appreciation and reliable income streams.

Enterprises and conglomerates seeking strategic real estate opportunities for portfolio expansion.

Professionals seeking to provide their clients with exclusive, off-market real estate opportunities that offer strong capital preservation and portfolio diversification.

Ultra-high-net-worth individuals and multi-generational families seeking direct access to premium real estate assets with customised investment structures that optimise risk and return profiles.

We identify premium real estate assets and conduct extensive financial, legal, and market analysis.

Our team structures investment solutions to align with investor objectives, optimising capital efficiency.

We enhance asset value through strategic property management, tenant optimisation, and market-driven enhancements.

KOSEC Group maximises returns through strategic exits, including property sales, refinancings, and joint ventures.

This site uses optional first-party and third-party cookies to enhance functionality and personalize your experience, perform analytics, and serve you with relevant ads on the Internet and social media. To find out more about our cookies, visit our Cookie Policy.