Proprietary deal flow in high-impact industries.

Rigorous due diligence ensuring scalable and sustainable investment opportunities.

Investing in industries positioned for continuous expansion.

Ensuring transparency and accountability in ESG-related investments.

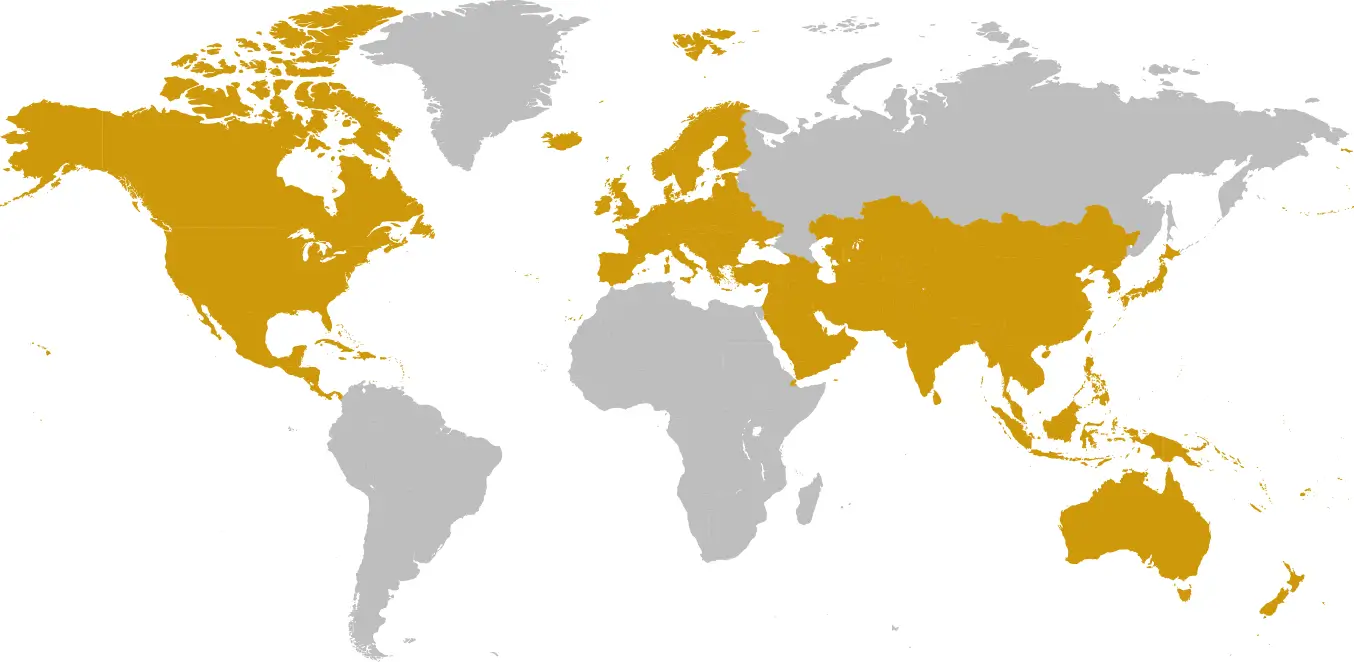

Collaborations with industry leaders, policy makers, and institutional investors.

Capital allocation into green energy, carbon credits, and circular economy initiatives.

Investments in underserved economies, fostering financial inclusion and infrastructure development.

Supporting innovation in medical technology, pharmaceuticals, and life sciences.

Backing disruptive startups that drive digital transformation and financial empowerment.

Investments that address housing shortages and improve community well-being.

Pension funds, endowments, and sovereign wealth funds seeking responsible, ESG-aligned investments that deliver long-term value and measurable impact.

Businesses and multinational enterprises looking to integrate sustainable investment strategies into their operations, leveraging ESG-driven growth opportunities.

Financial professionals providing clients with high-impact investment opportunities, ensuring capital is allocated to mission-driven projects with strong growth potential.

Ultra-high-net-worth individuals and multi-generational families seeking values-based capital deployment, supporting renewable energy, healthcare, financial inclusion, and social infrastructure projects that align with long-term sustainability goals.

We identify high-impact investment opportunities through comprehensive ESG criteria and sustainability analysis.

Our team structures investments to balance financial returns with positive societal contributions.

We monitor investments closely to ensure ongoing impact measurement and financial growth.

KOSEC Group facilitates strategic exits that maximise investor returns while scaling sustainable solutions.

This site uses optional first-party and third-party cookies to enhance functionality and personalize your experience, perform analytics, and serve you with relevant ads on the Internet and social media. To find out more about our cookies, visit our Cookie Policy.